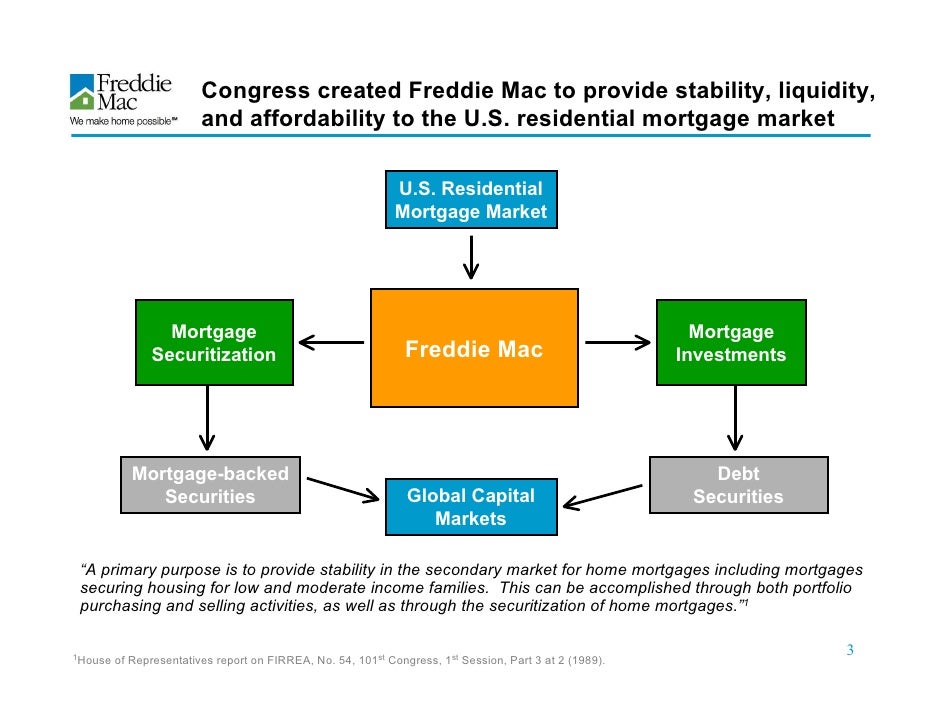

Commission revenue freddie mac – Freddie Mac, an essential gamer in the United States real estate market, promotes mortgage by buying them from loan providers. This elaborate procedure creates revenue, however just how precisely does this take place? It’s a remarkable tale of interconnected economic deals, with payment revenue being a crucial element. Picture a substantial network of loan providers, customers, and financiers all collaborating to make homeownership feasible. Freddie Mac, in such a way, works as a main center, helping with the circulation of funding and, subsequently, producing its very own income stream.

Understanding the Mechanism Think about it like a substantial market where home mortgages are dealt. Lenders, that stem these home mortgages, usually obtain a payment for bringing a consumer to the table. This payment isn’t straight paid by Freddie Mac. Rather, it’s component of the total deal charges that loan providers make when they shut a finance. Freddie Mac’s function is to buy these home mortgages at a fixed cost, and this deal cost takes into consideration the existing payment framework currently factored right into the home mortgage’s worth. The revenue Freddie Mac creates originates from the distinction in between the cost it spends for the cost and a home mortgage it later on offers it at in the additional market. It’s a little bit like an intermediary, however on an enormous range.

Factors Influencing Commission Income Numerous variables affect the quantity of payment revenue Freddie Mac indirectly gain from. One important variable is the total health and wellness of the real estate market. A solid market converts to greater need for home mortgages, possibly bring about even more commission-generating deals. Alternatively, financial slumps can reduce home mortgage task, influencing the total quantity of deals and the linked payment revenue. Rates of interest additionally play a substantial function. Changes in rate of interest straight influence the good looks of home mortgages, therefore affecting the variety of fundings being come from and the payment gained. Competitors amongst loan providers plays a duty. An open market can drive down payments, while a much less open market may permit greater payments to be gained. It’s a vibrant interaction of pressures.

A Glimpse right into the Numbers Exact numbers on Freddie Mac’s payment revenue are not openly readily available as it’s ingrained within the more comprehensive home mortgage deal procedure. Openly launched economic declarations will likely reveal accumulated revenue as opposed to a break down of private payment parts. One can presume the considerable range of this revenue based on the large quantity of home mortgages Freddie Mac takes care of. These numbers would certainly show the cumulative payment gained by loan providers as component of their solutions in shutting home mortgages, and Freddie Mac advantages indirectly by obtaining those home mortgages. Recognizing the details of these numbers needs a much deeper study Freddie Mac’s economic records.

- Market Conditions: Economic problems greatly affect the quantity of home mortgage task and therefore the relevant payments.

- Interest Rates: Changes in rate of interest influence the charm of home mortgages and the payment gained.

- Lender Competition: The degree of competitors amongst loan providers can affect payment degrees.